Trade Pips

trading inspired

Trade Pips offers an extensive selection of trading materials for forex, stocks, CFDs, indices, and bonds. These resources comprise tools, articles, research, and strategies. Additionally, our website showcases a high-quality forex trading tool – The Trade Pips Currency Strength Meter.

Currency strength is one of the most underrated trading tools.

Which is better?

- Look for strengths and weaknesses in a preselected currency pair.

- OR select the currency pair to trade based on the strongest and the weakest currencies on a given day or week.

With the second option, you already know the strength or the weakness of price.

“Trade Pips Currency Strength Meter” is our own tool to measure the comparative strengths between the major currencies (currently 4).

Elliott Waves Theory – Guide by Trade Pips

The Elliott wave theory – discovered by Ralph Nelson Elliott (1871-1948), mainly revolves around man’s mass psychology.

The patterns are still being used in trading even today. The only problem though, the application of Elliott’s principles is quite subjective.

But proper knowledge of the Elliott waves pattern-trading approach may provide wonderful insights to market movements and forecasting, like in our example forecast on…

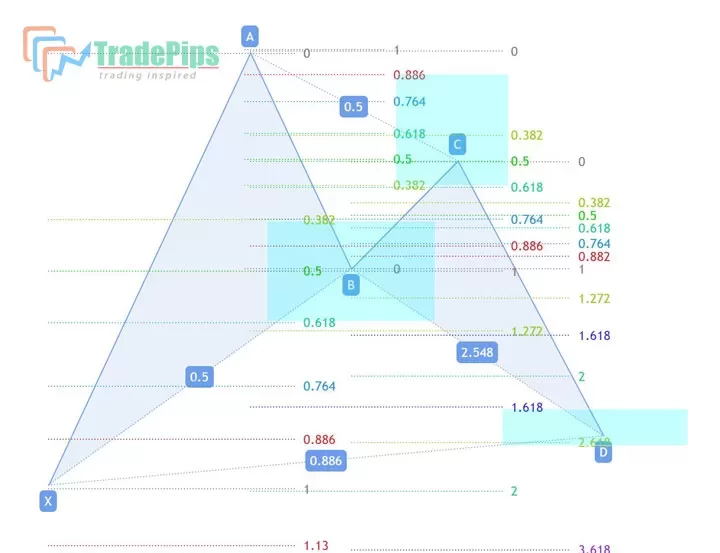

Harmonic Trading Guide

Harmonic patterns are called “harmonic” because of their inherent harmony with Fibonacci ratios.

Fibonacci extensions and retracements of multiple preceding waves create a nice confluence zone of ratios called PRZ.

Harmonic trading is the science of using Fibonacci ratios for trading. Pattern trading can be overwhelming. But, the secret technique is…

Latest posts

- Ichimoku Cloud Trading Strategy

Ichimoku cloud is a popular technical analysis tool used by traders. This article explains how to use the strategy to make profitable trades.

Ichimoku cloud is a popular technical analysis tool used by traders. This article explains how to use the strategy to make profitable trades. - Bollinger Bands trading strategy

The Bollinger Bands trading strategy is based on the idea that volatility tends to expand and contract over time, and that price tends to revert …

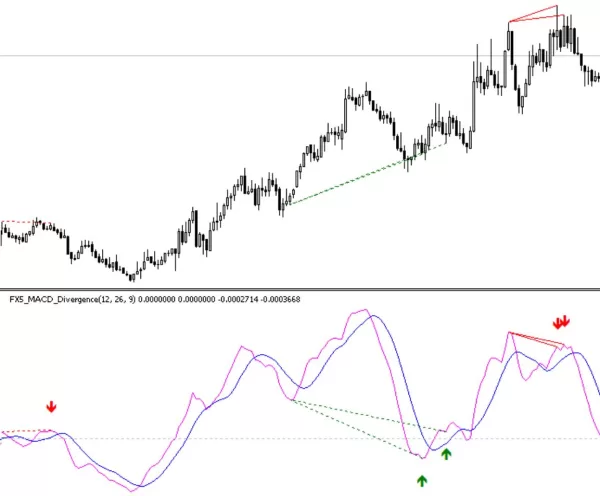

The Bollinger Bands trading strategy is based on the idea that volatility tends to expand and contract over time, and that price tends to revert … - MACD Divergence Trading Strategy

Introduction Moving Average Convergence Divergence (MACD) is a popular indicator used by traders to identify potential trend changes in the market. MACD divergence trading involves …

Introduction Moving Average Convergence Divergence (MACD) is a popular indicator used by traders to identify potential trend changes in the market. MACD divergence trading involves …